I guess I’m lucky after nearly 8 years in the business I have encountered only one cat hoarder. There was a guy whose pitbull chewed up the doorways of his apartment, who at least had the decency to leave us a month’s rent in addition to his security when he moved out. But the cat hoarder – that’s a new one on us!

MOST pet owners make great tenants. Their fur babies are family members. It’s hard to find a rental that will let you keep pets, and understandably so. Therefore, the majority of our pet-owning tenants have treated our rentals with the utmost respect.

We screen out most of the not-so-responsible pet owners with our terms. It’s expensive - $50 added rent per month for a dog, and that’s for each dog. So if the rent is $600, with the dog it’s $650. Two dogs it’s $700. Cats we charge $30 extra per month for up to two. Being a responsible pet owner is a financial commitment, we want to make sure our tenants know that going in. We’ve had prospective tenants walk away when they hear we charge that much extra, and that’s fine with me. If you’re not ready to commit what it takes financially to raise a fur baby, I’d prefer you live elsewhere.

Aside from the financial commitment, we require a veterinarian reference. Don’t have a veterinarian? Sorry, you’re not a serious pet owner. We also need you to give us the policy number of your renters insurance policy that covers your dog before we give you keys to the unit. Renters insurance is quite easy to get and it’s usually pretty cheap. Everyone should have it – if the building burns down my insurance isn’t going to cover your stuff. You’re going to pay a little more for it if you’re a dog owner, in some cases. But if you love your dog, if he’s truly a member of your family, you’ll find a way to afford it. If you don’t, you’re not a responsible pet owner.

Look I know it can be hard to make ends meet for a lot of renters. You have your monthly rent, you pay your own utilities in a lot of cases, there’s food, gas for the car, car payments, your cell phone, your Dish Network, I get it! And if you live and work in NEPA chances are you’re not bringing in a huge paycheck. But pets are a huge financial commitment – almost as much as a child! Maybe even more so – you can’t get on public assistance to help defray the costs of raising a pet. If you can’t afford all the costs associated with a pet, from food to vet care to obedience training to renters insurance – then maybe you should put off pet ownership until you’re in a better financial situation. Just sayin’.

For nearly eight years we’ve rented to (mostly) responsible pet owners. I would say 75% of our units contain at least one companion animal. We’ve been burned a few times – we no longer carpet our units if we can help it. We use laminate flooring or tile – much harder to damage and much easier to clean. We’ve added an entire page to our lease dedicated to our Pet Policy. But in all honesty, whenever we’ve been burned by a bad tenant the damage was usually caused by humans.

Would a no-pets policy have prevented the cat hoarder situation? Possibly. At the first sign of any pet at all we would have been able to shut it down. But this person had no regard for our pet policy that allowed her to keep 2 cats. What makes me think she’d have any regard for a no-pets policy? She snuck these additional animals in without notice. We never had any reason to enter her apartment. She paid her rent in full and on time. She never called for maintenance. There were only two units in that building, and her own son lived upstairs. The son was eventually kicked out for bringing in a large, unruly dog that was not on his lease. That’s when things started to unravel with the Cat Lady. I’m just glad we caught it when we did. Before it became newsworthy!

A quick google news search for “cat hoarder” revealed that 40 cats seems to be the minimum to attract the media. Even then you only get a little newspaper write-up:

http://altamontenterprise.com/10292015/dozens-cats-removed-elderly-womans-home-no-charges-pressed

“The air quality of the residence was questioned and concerning to my staff,” Sheriff Craig Apple said in a statement. “We were so concerned for the health and well-being of the homeowner…The residence, itself, is not fit for occupancy and is uninhabitable due to the number of cats, feces, cat urine, and garbage throughout the residence.”

Hoard up to 100 cats, and you might get TV coverage:

http://www.nbcchicago.com/news/local/Dozens-of-Cats-Found-Living-in-Abandoned-Chicago-Home-321267541.html

"The house that's immediately East of it, the children have been unable to come outside because of the smell, the flies, it's just a deplorable situation," he said.

Even the well-intentioned cat-rescuer can fall into hoarding: http://www.desertsun.com/story/news/local/cathedral-city/2015/10/30/family-cc-man-78-cats-overwhelmed-rescuer/74896250/

According to the city of Cathedral City, Estler’s house was in such poor condition that condemnation is being considered.

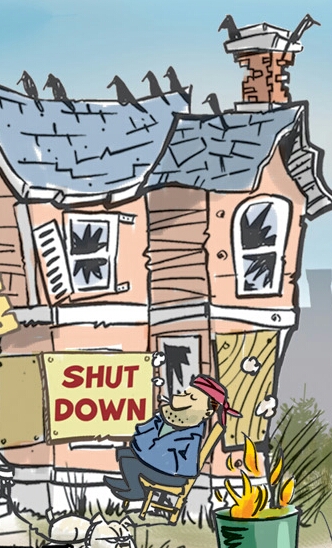

Condemned. Knocked down. Razed. I’m really glad we caught our cat hoarder in an earlier stage!

Recovering our rental from a Cat Hoarder. The first thing we had to do was get her out. She always paid her rent, so we had to file for a lease violation and we had to prove we’d given her written notice and time to correct the problem. Our property manager wrote the letter, giving her 10 days to relocate the cats or face eviction. The tenant claims she was able to place some of the cats, leaving her with 12 in our unit. Her ankles were covered in flea bites, she said she had eczema. She complained of an electrical problem in the unit – usually a stunt tenants will pull when they face eviction. We dispatched an electrician, she refused him entry. So we filed.

We got our eviction. 10 days passed, she didn’t leave, so we filed for the Constable and that was another 10 day waiting period. She stayed until the bitter end, when the Constable escorted her out and we changed the locks. Miraculously she had made arrangements for the cats, so we didn’t have to involve the SPCA.

Now we could begin the clean-up phase.

First, we had to remove all the furniture, clothes and garbage she left behind. Everything was destined for the burn pile. Fleas jumped on anyone who went in to do the job, including my husband. They ended up in his car – which he had to flea bomb. The only reason we didn’t have a flea infestation in our own house was we are vigilant pet owners who treat our cats with Revolution once a month. Fleas get in the house, jump on the cats, bite them and die.

Investors tip: if you choose to allow pets, insist in your lease that pets be treated with a flea treatment such as Revolution or Advantage. Proof of such treatment will be required in the case of a flea infestation. If proof cannot be provided, the cost of the flea extermination will be on the tenant. Yes we are making medical decisions for their animals. But if they don’t like it, they can find a different place to rent. The average cost of a flea extermination is $300.

Getting rid of the trash and furniture alone did not remove that ammonia smell. We figured we’d have to remove the laminate flooring in the living room and scrub the subfloor with bleach. That didn’t do it.

We removed the hard vinyl tile in the kitchen, found the subfloor had been rotted through from moisture – probably cat pee. We scrubbed that with bleach. And that didn’t do it.

We had to de-flea the basement. While we were down there, we spread lye. Then scrubbed the whole thing down, once again, with bleach. And that didn’t do it.

Next to go – the flooring and subfloor in the laundry room. We then used special encapsulating paint on all surfaces to lock in any lingering odor. Then we repainted the whole apartment, and scrubbed with bleach again. And that… didn’t do it.

We traced the smell to the kitchen cabinets of all places. We removed all the shelves in the cabinets, replacing them with plywood after painting the outer cabinetry with encapsulating paint. Then we removed all baseboard left behind from the ancient heating system we no longer used. The areas around them were scrubbed down, painted with encapsulating paint and then painted over to match the rest of the walls. And that did it. We think. It’s coming up on the first of December. That apartment was vacated mid-September.

Right now we’re waiting for the paint smell to fade so we can give it a good sniff test. If the ammonia is finally gone, like we think it is, it’ll be time to repaint the floors, throw down some new linoleum in the kitchen, and put in some nice new area rugs. Then we can rent it again. It won’t be hard to rent, there’s already a waiting list. It’s a first floor two bedroom with off street parking in a good school district. But we lost September, October, November, and possibly December rent income, plus the cost of remediation.

These are the kind of things that happen to landlords. It’s important to expect them, plan for them, and have the resources to deal with them. This was a huge blow to our business, but it did not put us under. We’re still here. It wasn’t the first huge blow to our business, and it probably won’t be our last. Rentals are the surest path to financial freedom. But it’s a path strewn with obstacles. My hope in writing this blog is to prepare would-be landlords for some real issues you are likely to face. Every time something like this happens I learn something new, get a new tool for my toolbox.

I wonder what I’ll add to the box in time for next week’s blog?

RSS Feed

RSS Feed